If you’re starting a small service-based business, taking on a virtual assistant gig, side hustling on Etsy, or beginning to work as a freelancer, accounting is probably not what you want to spend a lot of time or money on. You have a plan for getting money to come in, but how will you track it, pay yourself, or pay taxes? If you fall into any of the following categories, this post will help you navigate income that doesn’t come from a W-2.

-

graphic designer

-

photographer

- copy writer or content writer

-

virtual assistant

-

consultant

-

freelancer

-

self employed

-

someone with a side hustle

-

work from home

-

independent contractor

-

home business owner

-

blogger

-

influencer

- digital nomad

- anyone else without normal paychecks (we got out of that grind, right?!)

As a self-employed digital marketing specialist, I did a lot of research to find the best (and easiest!) accounting software. My biggest stress was worrying about how I would pay quarterly taxes. I was afraid that I’d have to hire an accountant to get it done right.

I’m obsessed with efficiency and doing business processes the best way I can. Hiring an accountant was out of my price range when I first started working with clients. I researched a lot of alternatives and found the one that met my needs- and offered a lot of features that I hadn’t even thought of. Intuit’s QuickBooks Self Employed is ultimately what I went with to manage daily accounting tasks and pay my pesky quarterly taxes. The software makes this so easy that I only have to spend a few hours every quarter to be compliant. Besides quarterly taxes, they also made it super easy to do my taxes at the end of the year. I don’t even have to hire an accountant for that! Here are the reasons I chose to go with Quickbooks.

Quarterly Taxes aren’t scary anymore

The most intimidating part of being self-employed was figuring out how to do quarterly tax payments. As an employee, your boss writes you a monthly check and takes out Social Security tax, Medicare tax, and Income tax. They calculate everything for you, and you just have to get that direct deposit and spend it. Being self-employed is way different. You have to track your monthly profits, figure out how much tax you owe to the government, and then send the payment. (You also have to pay the employer’s portion of your taxes, but that’s for another post.)

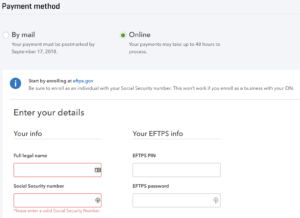

Intuit automatically calculates what I owe, integrates with the Electronic Federal Tax Payment System (EFTPS) and let me send payments directly from within the software. For something that was so intimidating in the beginning, I don’t give it a second thought now. (I just had to register through the government website, adding a bank account routing and account number, and wait for the acceptance letter in the mail. You can’t pay online without this acceptance letter, so make sure to enroll a month or two before you owe taxes- just in case. It includes a PIN and password that you need.)

This feature requires adding the Turbo Tax Bundle to the Self Employment software. The upgrade is totally worth it to me- see the info about tax time below.

Time required- 20 minutes every quarter to send the payment electronically

Track Spending Automatically

Keeping track of business expenditures with Intuit is super easy. It connects to my bank accounts and credit cards and shows each purchase. I can categorize my spending as business or personal, and label my business spending for reporting. It’s also simple to set up rules so that recurring monthly bills (like utilities, software, and my phone bill) are automatically put into the right categories.

Time required- 10 minutes a month to categorize expenses

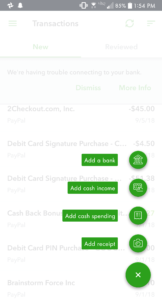

Easily Attach Receipts

This one goes with tracking your spending, but the receipt scanning really makes the process so easy. The free Intuit app lets me take a photo of receipts with my phone and adds them as new expenses. I keep a pile of receipts in my purse and then scan them all in at the end of the week. Easy peasy.

Time required- 10 minutes a week to scan and add receipts

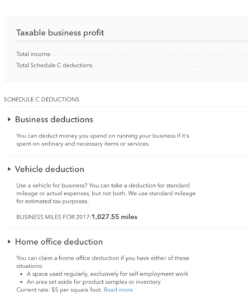

Track Miles without a Pretty Notebook

Buying a new notebook for writing your starting and ending miles is fun for the 25 minutes you spend on Pinterest picking it out. Remembering to record the miles every trip is a whole other story. Save your notebook for a to-do-list and use the QuickBooks app for automatic mileage tracking. I don’t have to worry about calculating my miles every time I take a trip. The app does it for me!

Time required- 5 minutes every week to label trips

![]()

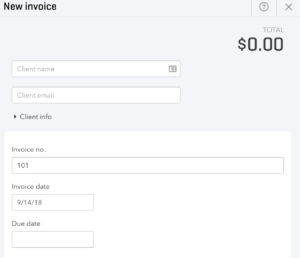

Invoice Your Clients and Accept Payments with Ease

Right now I’m using PayPal for invoicing and accepting payments, but Intuit has this capability as well. With industry-standing merchant fees (cheaper than PayPal actually), I would use it if I didn’t have to switch. You can see when a client has viewed or payed an invoice. Being able to invoice clients and accepting online payments is essential for presenting yourself professionally, and the easier you can do it, the better.

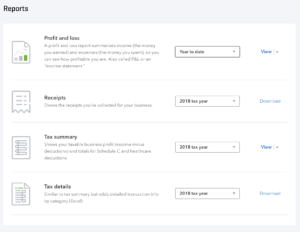

Create Reports and be Legit

As a prolific record-keeper, it’s important that I have paper documentation of my Profits/Losses, monthly spending, etc. Intuit makes it so easy to save reports as PDFs or to just print. It’s been a life saver when applying for insurance, getting a mortgage, and any other financial business that needs proof of income. I need documentation like this at least a few times a year. It’s so easy to pull out the printed report, or be able to verbally give an accurate number when people ask, because it’s already calculated. To me, this feature alone is worth the cost of the software.

Time required- 5 minutes a quarter

You DIY your own Federal Taxes too, Right?

If you get the Quickbooks Self-Employed + TurboTax Bundle, tax time won’t be a pain either. You can export your Self-Employed paperwork to Turbo Tax, and then file your Federal and State tax for FREE! I do my own taxes anyway, so paying the extra few dollars a month means that I’m not shelling out big time in April. (Let’s be honest- I like to get that stress out of the way in February 🙂

If you’re starting out as a self-employed business owner or a freelancer, checking accounting off of your list is a huge relief. Intuit Self-Employed has made tracking my expenses, mileage, and paying quarterly taxes a really simple part of running my business.

If you’re interested, use this link to get 50% off . You can get a basic plan for $5/month, but I personally add on the Turbo Tax Bundle so I don’t have to bang my head against a wall at tax time.